Investment Strategies

-

Balance process and outcome to refine strategy09/28/2025

Balance process and outcome to refine strategy09/28/2025 -

Map investment choices to specific life milestones09/25/2025

Map investment choices to specific life milestones09/25/2025 -

Stay flexible and adapt as markets and goals evolve09/22/2025

Stay flexible and adapt as markets and goals evolve09/22/2025 -

Apply glide path allocations for retirement portfolios09/18/2025

Apply glide path allocations for retirement portfolios09/18/2025 -

Track behavioral biases to improve decision making09/15/2025

Track behavioral biases to improve decision making09/15/2025 -

Invest with a long-term mindset for consistent success09/13/2025

Invest with a long-term mindset for consistent success09/13/2025 -

Test risk tolerance with hypothetical market scenarios09/11/2025

Test risk tolerance with hypothetical market scenarios09/11/2025 -

Review strategic asset allocation at least annually09/07/2025

Review strategic asset allocation at least annually09/07/2025 -

Plan exit strategies before making allocations09/02/2025

Plan exit strategies before making allocations09/02/2025 -

Factor in real returns after inflation and fees08/31/2025

Factor in real returns after inflation and fees08/31/2025 -

Apply fundamental screens for value investing08/29/2025

Apply fundamental screens for value investing08/29/2025 -

Monitor correlation shifts across your holdings08/25/2025

Monitor correlation shifts across your holdings08/25/2025 -

Manage leverage carefully to avoid portfolio risk08/23/2025

Manage leverage carefully to avoid portfolio risk08/23/2025 -

Stay disciplined with a written investment plan08/17/2025

Stay disciplined with a written investment plan08/17/2025 -

Include socially responsible investments for impact08/14/2025

Include socially responsible investments for impact08/14/2025 -

Map investments to upcoming cash flow needs08/12/2025

Map investments to upcoming cash flow needs08/12/2025 -

Use minimum volatility funds in uncertain markets08/10/2025

Use minimum volatility funds in uncertain markets08/10/2025 -

Adjust sector weights as economic trends shift08/08/2025

Adjust sector weights as economic trends shift08/08/2025 -

Understanding Your Risk Tolerance: The First Step in Investing08/06/2025

Understanding Your Risk Tolerance: The First Step in Investing08/06/2025 -

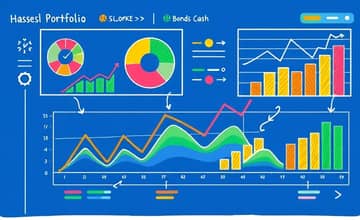

Tactical Asset Allocation: Adjusting Your Portfolio to Market Conditions08/06/2025

Tactical Asset Allocation: Adjusting Your Portfolio to Market Conditions08/06/2025 -

Balance speculative investments with a solid core08/05/2025

Balance speculative investments with a solid core08/05/2025

Latest Articles

-

10/27/2025Monitor vacancy rates in urban rentals for housing demand

10/27/2025Monitor vacancy rates in urban rentals for housing demand -

10/23/2025Track global remittance flows for migrant household income

10/23/2025Track global remittance flows for migrant household income -

10/18/2025Observe export diversification for economic resilience

10/18/2025Observe export diversification for economic resilience -

10/13/2025Monitor life expectancy for social policy needs

10/13/2025Monitor life expectancy for social policy needs -

10/10/2025Use direct deposit accounts for faster access to pay

10/10/2025Use direct deposit accounts for faster access to pay -

10/10/2025Study loan delinquency rates for banking sector health

10/10/2025Study loan delinquency rates for banking sector health